Q: Can I check my Policy ancillary limits including how much my listed dependants have left to claim?

A:

Using ACA Health’s Member Portal you can check by following these steps:

1. Log onto the Member Portal

2. Click on ‘Reports’ in the left hand side bar

3. Scroll down to ‘Your Cover Usage’

4. Click ‘Search by Member’

5. Select name via drop down

Q: How do I find information about medical specialist services?

A:

Medical Costs Finder is a tool to find and understand costs for medical specialist services across Australia.

Q: How can I search for a private hospital?

A:

Check that the private hospital is contracted with ACA Health through the Australian Health Service Alliance (AHSA) by using our Hospital Search.

Q: How do I find information about medical specialist services?

A:

Click on the links below for further information.

So, you need to see a specialist?

A guide to out-of-pocket medical costs – helping you plan for the cost of medical treatment

A guide for patients – choosing a specialist

Q: Will my baby be covered on my policy?

A:

Q: What are Restricted Services?

A:

Q: How do I switch who I am claiming for on the Mobile App?

A:

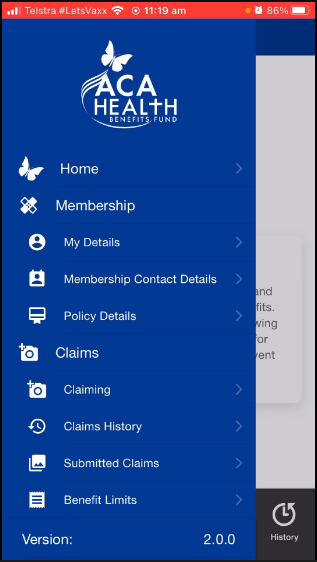

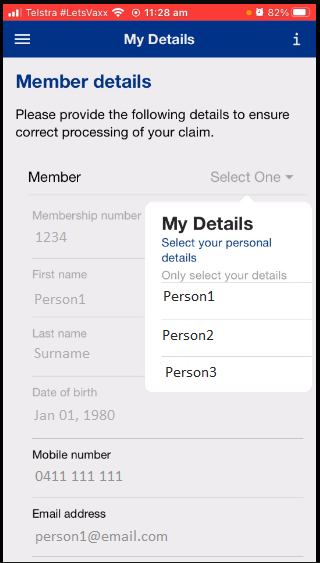

Select the ‘hamburger’ icon in the top left corner of the app and then select ‘My Details’.

From the drop-down menu select the person whom you wish to make a claim for.

Please note a mobile number and email address are required before you can select a person and click save.

Q: How to get the best value on your Orthodontic Services

A:

Q: Why should I join ACA Health before I turn 31?

A:

Q: What are Waiting Periods?

A:

Q: What are the benefits of Extras Cover?

A:

Q: What are Co-payments?

A:

Q: What are Excess Payments?

A:

Q: What is the Medicare Benefits Schedule and Access Gap Cover?

A:

This video will explain the Medicare Benefits Schedule (MBS) and the Access Gap Cover Scheme

Q: What is the Pharmaceutical Benefits Scheme (PBS)?

A:

Q: Are you preparing to go to hospital?

A:

Watch the video to see what 3 important things we recommend you do to prepare for your hospital visit

Q: My Mobile Claiming App isn’t working. What can I do?

A:

If your Mobile Claiming App isn’t working, please check on the App Store or Google Play Store whether the app has a software update available and please install this update.

If you’re still having issues with the app after downloading the latest update, we suggest you uninstall and reinstall the app and try again.

For further assistance regarding any issues with your Mobile Claiming App please call our friendly Customer Service team. In order for us to help you please let us know the nature of your issue, app version (e.g. 1.0.1) and device model (e.g. iPhone, Samsung).

Q: Where can I find Mental Health Resources?

A:

It can be hard to make sense of what you’re experiencing, and with so many different sources of information and advice, sometimes you just need a guide and some suggestions.

Head to Health is here to help you find your way to the right supports for you and your needs. Go to: Head to Health

Q: Will I need to make catch up payments if I suspend my membership?

A:

No contributions are due or payable during the period of suspension.

Q: Can I suspend part of my policy? I.e. Suspend the hospital and still access chiro/dental

A:

No. Fund rules allow for an entire policy to be cancelled not parts of. However, you can cancel your Ancillary cover and keep your Hospital cover or vice versa.

Q: How long can I be unfinancial for until you terminate my membership?

A:

ACA Health may terminate a membership where a Policy Holder is in arrears in their premium payments by 3 months or more. Please Note: ACA Health is not obligated to pay benefits if a policy is in arrears.

Q: Will I need the internet to use the Mobile Claiming App?

A:

Yes, in order to take any action or view current details on the app, you will need to use it while you are connected to Wi-fi or on Mobile Data.

Q: How can I download the ACA Health Mobile Claiming App?

A:

Search ACA Health in the search bar of Google Play, or App Store and download the icon with the blue butterfly labelled ‘ACA Health’.

Q: How do I change payment methods on the Mobile Claiming App?

A:

In order to streamline our Mobile Claiming process, all benefits for these claims will be directed to the direct credit details you currently have saved on file. If you need to update your direct credit details, please log on to your Online Member Services Portal and update your details there before submitting a Mobile claim.

Q: Can I update or make payments on the Mobile Claiming App?

A:

We are unable to offer any payment changes as a function on the app, but these features are in development for a future update. You can update your payment method and/or payment details through your Online Member Services Portal.

Q: I need to make a change to a claim I submitted on the Mobile Claiming App

A:

Once you have submitted a claim, it is automatically entered into a queue for our Claims Team to assess. In order to disregard a claim item or make any enquiries please call our friendly Customer Service Team on 1300 368 390. If needed, our team can cancel your claim and you will be able to submit a new claim through the Mobile Claiming App.

Q: I’m trying to attach a document from my phone and it isn’t working.

A:

Our Mobile Claiming App currently accepts .png or .jpg files only. We are developing the app to accept .pdf files and this will be released in a future update. You are still able to attach .pdf and .jpg files through your Online Member Services Portal.

Q: The instructions on what to include in a claim have disappeared! How do I find them?

A:

If you have turned off the Claims Help, you can turn these options back on again. Go to the Settings option on the menu and press the toggle on the right hand side of ‘View Submit Claims help’. You can also use the similar method to turn on ‘Submit Documents help’ if you have turned this off before.

Q: I have not updated my current address, and I have submitted a claim on the Mobile Claiming App. What do I do?

A:

Our claims team are very prompt. In order to make sure your remittance is posted to the correct address, please call our friendly Customer Service Team and they can update your address over the phone before your claim is entered. It is best to mention that you have submitted a claim so that we can check if your claim has been processed, and redirect your upcoming remittance if required.

Q: Why can’t I see the claim I just submitted on the Mobile Claiming App?

A:

If you are searching through the ‘View Claims’ function, this will allow you to pull up a history of claims that have been paid in the past.

For claims submitted on this device, click on the blue ‘Claiming’ heading in the menu, and choose the option ‘Claim Submissions’, this will reflect claims submitted through the app on this device. You will be able to view images of the invoices submitted, so if there is an invoice you think is missing then it has not been sent to our team.

Q: Can I submit a claim for multiple people on the Mobile Claiming App?

A:

When you submit a claim via the Mobile Claiming App unless explicitly printed otherwise on the invoice, the patient is assumed to be the person who is submitting the claim. If you would like to submit a claim on behalf of a different family member on the policy, you will need to go back to the page where you can change the user. Once you have entered the app as that user, any claim you submit will be assumed to be for that person.

Q: Can I submit more than one claim on the Mobile Claiming App?

A:

Once you have submitted a claim, it is automatically entered into a queue for our Claims Team to assess. If you wish to submit additional claims, you are able to take images and submit new claims for different services as much as you would like. Please remember that you can attach up to 4 .jpg files per claim.

Q: How to make a claim?

A:

- Click here for instructions to claim through our website.

- You can also submit a claim using our Email Claiming process.

- Download a Claim Form, fill in the details and post it to us with a copy of your invoices.

Q: I’m having a baby. What do I need to do about my cover?

A:

Check with ACA Health as soon as your pregnancy is confirmed, your current level of hospital cover and whether you are still under any waiting periods (12 months for obstetrics). You may need to upgrade to a family or single parent membership.

Single hospital membership for mothers only cover the cost of the birth of the baby but doesn’t cover any costs incurred by the baby. For a baby to be eligible for benefits immediately from birth, the mother must have contributed to a family or single parent membership for at least 2 calendar months prior to the infant’s birth. (Regardless of whether or not the infant is premature)

When the baby is born, he/she will be considered an out-patient and as such, Medicare pays the first 85% of the scheduled fee and you must meet all costs not covered by Medicare. ACA Health is not permitted to pay benefits on these out-patient fees.

Your newborn (nine days old or less) is only classified as an ‘admitted patient’ if the baby:

- is admitted to an Australian Government approved neonatal intensive care unit; or

- is the second or subsequent baby born in a multiple birth; or

- is in hospital without his/her mother.

Q: What if I have to go to hospital as an emergency?

A:

In NSW or ACT, you are covered in full for ambulance transportation with hospital or extras cover. In all other states, ambulance is covered only under general treatment products.

If you go to an emergency department of a private hospital, you will be classed as an ‘out-patient’ and as such ACA Health is not legally permitted to pay benefits on these services or any blood tests or x-rays that may be taken at this time. These fees are instead reimbursed by Medicare, as services provided to “not admitted patients”, at 85% of the Medicare Schedule Fee.

Many private hospitals also charge a ‘facility fee’ for attendance at their emergency department to help off-set their running costs. ACA Health does pay a benefit towards this fee.

If, after emergency treatment, you require admission to the hospital, you will then be covered by your Hospital cover with ACA Health (provided all waiting periods are served and the treatment is covered by your hospital cover).

Q: What do I need to do if I have to go to hospital?

A:

If you need hospital treatment, we recommend the following steps to determine your benefit and the amount of gap fees you may need to pay:

- Contact us straight away to find out your level of hospital cover and whether you will be covered for the treatment you need.

- Ask your doctor(s) whether they participate in the Access Gap Cover Scheme and if so, to bill your accordingly. This may help you avoid or lower your out-of-pocket expenses.

- Check that the private hospital is contracted with ACA Health through the Australian Health Service Alliance (AHSA) by using our Hospital Search.

If your hospital stay is longer than 35 days and your doctor considers that you no longer need acute care, you will need to pay a contribution to your living costs in much the same way as nursing home type residents contribute to the cost of their care. The patient contribution is payable by public and private hospital patients and ACA Health is unable to pay benefits on this fee. Contact us for more information.

Q: I need a statement of benefits for my tax return, what do I do?

A:

You can download your claims history from within your member account portal. This will list all the claims and benefits paid on your membership. Privacy laws require that all persons on the membership need to give permission for the release of their claims information (within reason for age purposes).

Q: Is there a time limit on claiming?

A:

ACA Health require that all claims for benefits need to be received at our office within 24 calendar months from the date of service.

Q: Are there any travel cover options for my family and me?

A:

Please refer to our Travel Page for more information.

Q: Can I change providers mid-year?

A:

You can change your healthcare provider at any time. If you do choose to change healthcare providers you will be required to get a tax statement from each provider to complete that year’s tax return.

Q: Can I choose my healthcare provider?

A:

Yes, as long at the treatment provider is appropriately qualified and registered with their relevant association.

Q: How fast is the claims process?

A:

The majority of claims are processed within 5 working days, and with your ACA Health membership card, many extras claims can be made automatically at the time of your service.

Q: How can I claim a benefit?

A:

Many general treatment providers offer on-the-spot electronic claiming (called HICAPS), which means by using your ACA Health membership card, you’ll know on the spot what we pay on the claim and all you need to do is pay the difference. If your healthcare provider does not offer electronic claiming, you will need to post or deliver your original invoice/receipt along with an ACA Health Claim Form to us for assessment. Your claim will be processed within 3−5 business days and paid by direct deposit to your nominated account or by cheque to the address listed on your membership. If your claim is unsuccessful, it will be returned to you with a letter explaining why it cannot be paid.

Q: What is HICAPS and how does it work?

A:

HICAPS (Health Industry Claims and Payments Service) is an electronic health claims system now used throughout many healthcare providers. It allows you to automatically claim benefits on the spot by using your ACA Health membership card.

By using HICAPS you will save time, as you will no longer have to lodge your claim via the post. And, more importantly, you will save money because you won’t be out of pocket during the time it takes to claim the benefit back from us.

Q: Can I claim benefits from ACA Health for doctors` fees outside of hospital, such as a visit to my GP?

A:

No. Health funds are not legally permitted to pay benefits on ‘out-patient’ medical treatments. Patients are only eligible for the 85% Medicare rebate on medical services incurred out of a hospital.

Q: What do I do if I lose my ACA Health Membership Card?

A:

If you lose your membership card, don’t panic! Just contact us to let us know and we will order you a replacement card.

Q: What happens if there is a change in student dependent status?

A:

If your child aged over 21 stops studying, goes to part-time study, gets married, or starts earning over the tax-free threshold, you need to tell us in writing as they can no longer be covered under your standard family membership.

Your child can choose to have their own policy, with no waiting periods, provided they join with ACA Health within two months of coming off your membership.

Alternatively, the Dependent Extension product allows unmarried children from the age of 21 and under 31 who are no longer studying full-time, to stay on the Family Membership. By taking out the Dependent Extension, the membership premium is increased by 30%.

The Dependent Extension option is only available on combined covers below;

- Gold Deluxe Hospital and Complete Ancillary

- Gold Deluxe Hospital and Ancillary Lite

- Gold Private Hospital and Complete Ancillary

- Gold Private Hospital and Ancillary Lite

Q: Can my defacto partner be covered under my membership?

A:

Yes, defacto partners can be covered under a family membership.

Q: How do I add a baby or a new dependant to my family membership?

A:

All you need to do is complete a Membership Change Form with the details of the new dependent to be added by logging onto your member account via Online Member Services.

Q: Do I get any discounts with partner companies?

A:

Members of ACA Health are eligible for a number of discounts at a range of optical providers on both prescription and non-prescription products. *Simply present your ACA Health membership card when making a purchase.

Click on the links below to see the discounts available:

*ACA Health Benefits are only paid on prescription services, however you may still be eligible for any applicable discounts on non-prescription products. Please contact the appropriate optical provider for more information on the offers.

ACA Health’s Travel Insurance Partner also offers members travel insurance at a discount! Click here for more information about this offer.

Q: What happens if I am going to live overseas?

A:

Members are still eligible to remain with ACA Health when moving overseas, and are still eligible to receive benefits for treatments received in Australia. However, it is strongly recommended that private health insurance cover is organised within the country of residence to take care of treatments received overseas.

Members of ACA Health who are moving overseas for more than four months may instead wish to request ACA Health have their membership suspended, which can be lodged through online member services.

Q: Can I manage my membership online?

A:

With ACA Health’s Online Member Services you can access a range of online services at a time convenient to you, including:

- check your ‘limit usage’ − how much you have already claimed for extras items, and how much you still have left for that calendar year

- change your contact details

- change your payment/bank account details

- change your type of cover

- add a partner/child to your membership

- make a credit card payment

- view your membership details

- make a claim

- find a provider

- download your tax statement or claims history.

Q: What happens if my family circumstances change (e.g. divorce, children)?

A:

All you need to do is complete an online Membership Change Form with the details of the new dependent/person to be added or removed from the policy.

Q: What is the Medicare Levy Surcharge?

A:

The Medicare Levy Surcharge (MLS) encourages high income earners to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public system.

Where high-income earners do not take out private health insurance, they are charged an additional 1% on their taxable income on top of the usual 1.5% Medicare Levy.

For more information, click here.

Q: How does Access Gap Cover reduce my out-of-pocket expenses?

A:

In the past, large out-of-pocket expenses were often part of any hospital stay for people with private health insurance. To help improve this, ACA Health offers you the Access Gap Cover Scheme as part of our hospital cover.

Medical (doctor/specialist) services provided to hospital in-patients are charged separately from hospital accommodation/theatre fee charges. Medicare pays 75% of the Medicare Schedule Fee and ACA Health pays the remaining 25%.

Some doctors/specialists charge an amount above the Medicare Schedule Fee. These costs are generally referred to as out-of-pocket expenses, and in the past, health funds were unable to pay benefits on these amounts.

Now, out-of-pocket doctor/specialist expenses for hospital patients can be eliminated completely or dramatically reduced with our ‘Access Gap Cover’ payment and billing scheme.

Doctors/specialists who choose to participate in the ‘Access Gap Cove’ scheme agree to charge for services with either no out-of-pocket expenses or a predetermined amount, which is capped. In return, ACA Health can pay the doctor above the Medicare Schedule Fee.

ACA Health has “Access Gap Cover” arrangements with over 11,000 Doctors Australia wide, established on our members’ behalf by the Australian Health Service Alliance (AHSA). You can find out which doctors are using the scheme by logging into your Member Portal and clicking the “Find a doctor” button at the bottom of the page (click here to login). Not all doctors in the scheme have agreed to have their names listed, so keep this in mind when you are looking.

Finally, your doctor will usually lodge your claim for you − making the whole process even easier.

Please note: ACA Health is unable to provide recommendations on health care providers, hence the search function is not intended as a list of ‘preferred providers’.

Q: What is the Australian Government rebate and what does it mean for me?

A:

The Federal Government provides a rebate on health insurance to all Australians eligible for Medicare who are members of a registered health fund, in recognition of the contribution that those with private health insurance are making to their own health care costs.

This rebate is now age and income tested. This rebate is available on all ACA Health hospital and extras products.

Please visit the Private Health Website to check if a rebate applies to your age and income level.

As a member of ACA Health Benefits Fund you can choose the rebate claiming method that best suits you.

You can receive the rebate as either:

- A premium reduction through ACA Health; or

- A refundable tax rebate in your annual tax return

Q: What is Lifetime Health Cover and how does it affect me?

A:

Lifetime Health Cover is a Government initiative that rewards those who take out and maintain hospital cover at a younger age with lower premiums throughout their life (compared to someone who joins later in life).

To lock in the lowest premiums for life under Lifetime Health Cover, a person needs to take out hospital cover with a registered fund before the first July 1 following their 31st birthday. After 31, the younger you join, the lower your premiums will be.

Under Lifetime Health Cover, health funds are required to charge people who were not members of a hospital cover prior to 1 July 2000, 2% extra on top of the normal premiums for every year they are aged over 30 when they first take out hospital cover.

For more information on Lifetime Health Cover, please refer to the Private Health website or contact us.

Q: How do I find out what my gap will be before I go into hospital?

A:

Depending on your level of hospital cover, there may be some out-of-pocket expenses (‘gap’) for your hospital accommodation. Call ACA Health on 1300 368 390 to confirm your cover and inquire about any gaps that you may have to pay.

If you are having a procedure performed in hospital, you can ask your surgeon to provide you with a quote first. This information will inform you of any out-of-pocket expenses that you may incur for your surgeon’s fees as well as any other associate doctors/specialists fees for your procedure.

Q: Am I covered for cosmetic surgery with Deluxe Hospital cover?

A:

Cosmetic Surgery is not unconditionally covered under any of ACA Health’s hospital or extras products. Prior approval for this type of service must be obtained from the Fund committee and must be recommended by a Registered Medical Practitioner.

Q: Will I have to pay out-of-pocket expenses for Surgically implanted Medical Devices and Human Tissue Products*?

A:

These include pacemakers, defibrillators, joint replacements and other devices that are surgically implanted during a stay in hospital. There are often a number of different choices available with any particular Surgically implanted Medical Devices and Human Tissue Products, which can vary in cost and benefits.

The Department of Health and Aging has set a Surgically implanted Medical Devices and Human Tissue Product List with the majority as ‘No Gap’ which means you do not need to pay any out-of-pocket expenses. You and your surgeon will be able to choose a Surgically implanted Medical Devices and Human Tissue Product for every Medicare procedure from the Surgically implanted Medical Devices and Human Tissue Product list that will be fully covered by ACA Health.

In the situation where a more expensive Surgically implanted Medical Devices and Human Tissue Products is available for your surgery, and you elect to use one of these, you will have to pay the gap amount.

Before you have any surgery, check with ACA Health that you will be covered under your current policy.

*Formerly known as Prostheses.

Q: Do I have cover for treatment anywhere in Australia?

A:

Yes. ACA Health is a National fund and will pay benefits for treatments and services administered anywhere in Australia.

Q: Are there family discounts?

A:

Yes. ACA Health provides cover for the member, as well as the member’s nominated partner and/or dependents.

Children are considered dependent until the age of 21, or 25 if they are an unmarried full-time student and earning less than $30,000 per year.

The Dependent Extension product allows children from the age of 21 and under 31 who are no longer studying full-time to stay on the Family Membership. By taking out the Dependent Extension, the membership premium is increased by 30%. The Dependent Extension is only available on combined covers with Gold Deluxe or Gold Private Hospital cover.

Q: Can I go to any private hospital?

A:

Our Deluxe Hospital cover and Private Hospital cover means you can choose to be treated in any hospital in Australia. However, for hospitals that are not contracted with us through the Australian Health Service Alliance (AHSA), we cannot guarantee you for the full 100% of the cost as we can for contracted hospitals.

Q: What level of general health benefits do you provide (e.g. physio, contact lenses)?

A:

ACA Health is able to give you the choice of cover you need with a wide range of benefits without the confusion of too many options. Our Complete Extras is an excellent product, often offering higher benefits than comparable products at many other funds. It offers generous benefits on a large number and wide range of services including:

- general and high cost dental

- orthodontics

- optical including glasses and contact lenses

- ambulance

- physiotherapy/hydrotherapy

- chiropractic/osteopathy

- pharmacy

- speech therapy

- orthoptics

- acupuncture

- remedial massage

- general appliances, e.g. CPAP machine, wheelchair

- hearing aids

- audiology

- occupational therapy

- natural therapies.

For more information on our Extras cover, click here.

Why not give our quick quote option a try to find the right coverage for your needs.

Q: Will I be covered for various stages of life (e.g. pregnancy)?

A:

Definitely. We have a range of policies that cover you across the many different stages of your life, including pregnancy.

Under our Complete Extras family cover, mothers-to-be and new mothers can now access a range of new benefits to help families meet the costs associated with having a baby. These include:

- pre- and post-natal classes

- settling classes

- lactation consultations

- appliances for hire or purchase (e.g. breast pump)

- infant sound and respiratory monitor (to help in the prevention of SIDS).

Benefits available are 80% of the cost, up to a maximum of $500 per family membership.

Q: What policies are available?

A:

We have a choice of 4 hospital covers:

Any of these can be combined with an Extras cover to suit your health needs and financial commitment.

Extras cover helps you take care of the costs for all the extras − like dental, optical, physio, chiro, and pharmacy prescriptions.

We offer you two excellent choices for Extras cover:

Either of these products can be used alone, or combined with Hospital cover to meet your health needs and financial commitment.

Click here to find out the best coverage for your needs.

Q: What can I do if I feel I have been treated unfairly by ACA Health?

A:

If you are unhappy with the treatment you have received from ACA Health you first need to contact us and we will attempt to find a satisfactory resolution. If you are still unsatisfied after exhausting our internal complaints resolution options (view our Complaints Procedure and Policy), you are welcome to contact the Private Health Insurance Ombudsman (https://www.ombudsman.gov.au/complaints/private-health-insurance-complaints).

Q: Will my information be shared with any preferred providers or business partners?

A:

ACA Health may disclose your personal information to third parties in order to provide and administer its products and services. This may include disclosures to:

- hospitals and health service providers from whom you have sought, or from whom you intend to seek treatment

- health management providers who offer health management and chronic disease management programs under an arrangement with ACA Health

- Government agencies such as the Australian Tax Office, Medicare Australia, the Private Health Insurance Administration Council, the Private Health Insurance Ombudsman and the Department of Health

- other private health insurers, for instances where you transfer to or from another private health insurer

- the Fund’s information technology and software system providers

- third party advisers and service providers to the Fund (such as auditors, actuaries, consultants and legal advisers).

Refer to our Privacy Policy for more details.

Q: Will my privacy be protected?

A:

ACA Health is committed to maintaining the privacy of individuals. The personal information we collect is in accordance with the Australian Privacy Principles set out in the Commonwealth Privacy Act and other applicable privacy legislation. Refer to our Privacy Policy for more details.

Q: Is there a cooling off period?

A:

ACA Health will allow any member who has not yet made a claim, to cancel their policy and receive a full refund of any premiums paid within a period of 30 days from the commencement date of their policy.

Q: What payment options are available?

A:

We want to make the payment of your contributions as painless and easy as possible. You can choose a number of different payment methods and are able to nominate whether you would like deductions to be made monthly, quarterly or yearly.

You can choose to pay via:

- direct debit

- credit card − MasterCard and Visa only

- payroll deduction (option only available to selected organisations)

- by mail or in person with cash

You can nominate your preferred payment option on your application form. However, you can change your payment method at any time through the online member portal.

Q: Is it hard to change funds?

A:

It’s easier than you think. Joining ACA Health is as simple as filling out our online application form – click here.

When we are processing your application, a Member Service Representative will contact you to talk through the details of your new membership.

Q: How soon will I get cover? What’s the waiting period?

A:

On joining health insurance for the first time, waiting periods must be served before benefits will be paid on all hospital and general treatment covers with ACA Health. The exception to this is where you have an accident, not related to pre-existing condition, and you require hospital and/or ambulance treatment.

If you transfer from another fund within 60 days of terminating your old cover, then normal waiting periods are waived and our benefits up to the level of your previous cover may be paid immediately, subject to financial continuity.

Waiting periods

| Accident requiring hospitalisation | No waiting |

| Ambulance (Emergency) | No waiting |

| Dental | 9 months |

| Obstetrics | 12 months |

| Hearing aids and health appliances | 12 months |

| Treatment relating to pre-existing condition | 12 months |

| All other services (inc psych, palliative and rehab) | 2 months |

The Mental Health waiting period exemption for higher benefit is available to each insured person on a hospital policy one in their lifetime and will apply from the beginning of a current admission if the election (fund was notified) was made within 5 days of admission, if not from the date of the election (fund notification received) where;

- The 2 month psychiatric/rehabilitation period has been served

- It is for psychiatric or drug and alcohol related treatment

Q: What does it mean by waiting period?

A:

On joining health insurance for the first time, waiting periods must be served before benefits will be paid on all hospital and general treatment covers with ACA Health. The exception to this is where you have an accident, not related to pre-existing condition, and you require hospital and/or ambulance treatment.

If you transfer from another fund within 60 days of terminating your old cover, then normal waiting periods are waived and our benefits up to the level of your previous cover may be paid immediately, subject to financial continuity.

If changing to a higher level of cover, normal waiting periods will apply before the higher benefits will be paid.

If adding a spouse to a membership (changing from single to family membership), normal waiting periods will apply for the spouse, unless they are transferring from another fund in which the rule above will apply.

If adding a child dependent to a membership, the child would be subject to the normal waiting periods, unless they are transferring from another fund in which the rule as above will apply.

If adding a newborn to a family membership, the baby will be covered immediately.

Please note: – If you are planning to have a baby and are currently on a singles cover, you will need to upgrade your cover to a family membership at least 2 months prior to the actual birth of the baby to ensure that your newborn will have immediate cover as part of your membership.

Waiting periods

| Accident requiring hospitalisation | No waiting |

| Ambulance (Emergency) | No waiting |

| Dental | 9 months |

| Obstetrics | 12 months |

| Hearing aids and health appliances | 12 months |

| Treatment relating to pre-existing condition | 12 months |

| All other services (inc psych, palliative and rehab) | 2 months |

The Mental Health waiting period exemption for higher benefit is available to each insured person on a hospital policy one in their lifetime and will apply from the beginning of a current admission if the election (fund was notified) was made within 5 days of admission, if not from the date of the election (fund notification received) where;

- The 2 month psychiatric/rehabilitation period has been served

- It is for psychiatric or drug and alcohol related treatment

Q: Can I claim benefits as soon as I join ACA Health?

A:

If it is the first time you have had private health insurance you will first need to serve waiting periods before you can make a claim. This is to prevent people from simply joining to make a claim and then dropping their cover, and therefore preventing higher costs for everyone.

If you transfer from another fund within 60 days of terminating your old cover, then normal waiting periods are waived and our benefits up to the level of your previous cover may be paid immediately, subject to financial continuity.

Q: How do existing/ongoing issues/disabilities affect my policy?

A:

A pre-existing condition is an ailment or illness where, in the opinion of a medical practitioner appointed by ACA Health, the signs or symptoms existed at any time during the six months before the day that a member joins private health insurance or upgrades to a higher level of cover.

Pre-existing conditions have an extended waiting period − 12 months − before hospital and major extras benefits will be paid on treatment relating to the condition.

The Mental Health waiting period exemption for higher benefit is available to each insured person on a hospital policy one in their lifetime and will apply from the beginning of a current admission if the election (fund was notified) was made within 5 days of admission, if not from the date of the election (fund notification received) where;

- The 2 month psychiatric/rehabilitation period has been served

- It is for psychiatric or drug and alcohol related treatment

Q: How do I join?

A:

Joining ACA Health is as simple as filling out our online application form – click here.

Alternatively, you can print out a copy of the application form and once completed you can return it to us by:

Post: Locked Bag 2014, Wahroonga NSW 2076

Email: [email protected]

You can also contact us on 1300 368 390 to discuss any details of your application.

When we receive your form, one of our friendly Member Service Representative will contact you to talk through the details of your new membership. As ACA Health is open to current and past employees of the Seventh-day Adventist Church and its incorporated institutions, we may ask you some questions about your personal or family connection to verify your eligibility.

Q: What are the benefits of joining ACA Health?

A:

We offer:

- benefits of up to 4 times your annual fee

- unbeatable range of extras with per treatment payments over double other health funds

- 100% of our operating surplus goes back to members

- ACA Health is only for members of the Seventh-day Adventist Employee Community

- impressive 99% member satisfaction from Discovery Australia

- part of the Members Own Health Funds – an alliance of 18 like-minded not-for-profit funds

- Our Infinite Hospital Promise means that we help lessen out-of-pocket expenses on Medicare approved hospital items with no restrictions, limits or exclusions

- ACA Health is large enough to make these generous payouts when you really need it, not 6 months later.

Q: My father worked for Sanitarium for many years but has recently passed away. Is it still possible to join ACA Health?

A:

Having a parent who was a past employee of an Adventist company means that you are definitely welcome to join us. When you apply to join, you will be asked to provide details of your father’s employment such as employment period and company details.

Q: My husband is an employer of an Adventist Company but we are getting a divorce. Can I remain a member of ACA Health?

A:

Yes. You may also want to contact one of our friendly Member Service Representative about limiting or preventing access to some areas of your membership for privacy purposes.

Q: Am I eligible to join if I only work part-time or on a contract basis?

A:

Definitely, as an employee we would welcome you as our valued member.

Q: My sister worked for an Adventist company but left in 2011. Does that mean I can still join ACA Health?

A:

Yes, you would be eligible to join. When you apply to join, you will be asked to provide details of your sister’s employment such as employment period and company details.

Q: Am I eligible if I have a family member who is or was a member?

A:

Partners/ spouses, dependants, siblings, parents and grandchildren of eligible persons are welcome to join. Eligible persons include present and past employees of incorporated companies affiliated with the Seventh-day Adventist Church in Australia. See Who can join? for more information.

Q: Do I have to be an Adventist?

A:

No. Membership with ACA Health is open to:

- Past ACA Health Members

- Present and Past Employees of incorporated Companies affiliated with the Seventh-day Adventist Church in Australia including:

- Sanitarium Health and Wellbeing Company

- Life Health Foods

- Vitality Works

- Sydney Adventist Hospital

- Signs Publishing Company

- Adventist Development & Relief Agency

- Avondale College of Higher Education

- Adventist Schools

- Adventist Retirement Villages

- ACA Health Benefits Fund

- Karalundi Aboriginal Education Centre

- Mirriwinni Gardens Aboriginal Academy

- A person who is, or was, a literature evangelist, while distributing for Home Health Education Service

- Local Church Officers in appointed positions such as Elders, Deacons, Deaconesses, Clerks, Treasurers, Communication Secretaries, Bible School Coordinators, etc.

- Partners/Spouses, Dependants, Siblings, Parents and Grandchildren of eligible persons mentioned above are also welcome to join.

Q: Who can join ACA Health?

A:

Membership with ACA Health is open to:

- Past ACA Health Members

- Present and Past Employees of incorporated Companies affiliated with the Seventh-day Adventist Church in Australia including:

- Sanitarium Health and Wellbeing Company

- Life Health Foods

- Vitality Works

- Sydney Adventist Hospital

- Signs Publishing Company

- Adventist Development & Relief Agency

- Avondale College of Higher Education

- Adventist Schools

- Adventist Retirement Villages

- ACA Health Benefits Fund

- Karalundi Aboriginal Education Centre

- Mirriwinni Gardens Aboriginal Academy

- A person who is, or was, a literature evangelist, while distributing for Home Health Education Service

- Local Church Officers in appointed positions such as Elders, Deacons, Deaconesses, Clerks, Treasurers, Communication Secretaries, Bible School Coordinators, etc.

- Partners/Spouses, Dependants, Siblings, Parents and Grandchildren of eligible persons mentioned above are also welcome to join.

Q: Does ACA Health offer travel Insurance?

A:

Please refer to our Travel Page for more information.

Q: Are there government incentives for joining a private healthcare fund?

A:

In recognition of the contribution that those with private health insurance are making to their own healthcare costs, the Federal Government provides a rebate on health insurance to all Australians eligible for Medicare.

You can receive the rebate as either:

- a premium reduction through ACA Health Benefits Fund; or

- a refundable tax rebate in your annual tax return

The rebate is age and income tested. Please click here for age and income tier levels.

Q: Why isn’t Medicare enough?

A:

Medicare offers you treatment in a public hospital and that may mean a long waiting list. You will also not be able to choose your own healthcare provider.

If you choose to be a self-insured private patient, Medicare pays a percentage of the schedule fees for private inpatient medical treatment such as those provided by surgeons and anesthetists. As their fees can often be well above the scheduled fees, the resulting gap for you to pay can sometimes be quite large.

Finally, Medicare doesn’t cover those ‘extras’ which arise in life such as dental, optical, and physio treatments.

Q: Why do I need private health insurance?

A:

Only private health insurance can give you the freedom and control to decide when, where and by whom, hospital and general treatments will be provided to you and your family.

With private health insurance, you gain the benefits of:

- shortened or no waiting lists

- coverage for the ‘medical gap’ balance – the payment required after the Medicare benefit and the schedule for private in-hospital medical services

- extras, such as dental, optical and orthodontic, physiotherapy, ambulance and many other important services.

Q: Where do I find out the latest news and events for ACA Health?

A:

We regularly update our website with exciting news. We also keep in contact with our members through our HealthWise Newsletters and HealthyBite emails, so make sure you have your email details up to date.

Q: Where do the profits go?

A:

We invest 100% of our profits back into making our policies better so our valued members are happier. You and your family are at the core of everything we do, rather than the focus being on what benefits the shareholders, Governments or overseas investors.

Q: What are the fund’s values?

A:

You can be confident that we are always here to assist and support you, when and where you need it most.

Fund values:

- Members First, Last and Only – Our interactions and service will exceed expectations

- Unbeatable Extras – We listen to our members when they tell us what is most important to them

- Ethics Before Profits – We will be fair and do the right thing every time

- Supporting Each Other – We will support each other to get the job done and meet our goals

Q: What kind of support does ACA Health offer?

A:

ACA Health provides you with the support you need by offering well-priced, quality products and benefits of up to four times your annual premium. In addition, you will find that our benefit payments on claims are over double that of other health funds.

Our support extends to exceptional customer service, online membership management plus the peace-of-mind knowing that we are here to assist you to receive the services you require when you need them.

Q: Why choose ACA Health?

A:

We care about our valued members and not profits, giving 100% of the surplus back to you. We provide extras that pay up to twice as much as the big three health funds on optical, dental and orthodontic.

You make the decision on the health provider you need to see and the type of treatment you receive. We are all about choices, value for money, great service and providing you with peace of mind.